Dec. 18, 2015 | Cody Stuart

Mortgage changes expected to slow housing demand

Local housing industry experts say a change that governs the amount buyers are required to put down when purchasing a home will significantly impact Calgary's already sluggish market.Effective Feb. 15, 2016, the change announced by the federal government in early December will raise the minimum down payment for new insured mortgages from five to 10 per cent on the portion of the house price above $500,000.

"The intent of [the change] is to pull back demand, and they're slowing demand in a market where we're already seeing demand slow," said CREB® chief economist Ann-Marie Lurie, noting resale residential sales in Calgary have already dropped nearly 20 per cent from the 10-year average.

"That's the challenge. It's something that was blanketed to really target markets like Vancouver and Toronto, but there's the unintended consequence in Calgary where we're already facing slower demand.

"Is it going to blow up the market? No, it's just going to further pull back demand at a time when we already have reduced demand. We're already facing challenges in the higher end of the market right now, and you're causing further challenges."

The five per cent minimum down payment for properties up to $500,000 remains unchanged.

Those purchasing properties priced $1 million or more will also continue to require a minimum down payment of 20 per cent.

Because the new rule will largely impact the detached sector, Lurie believes the change is likely to be felt most by move-up buyers. Based on Calgary's detached benchmark price, the average first-time buyer would require an additional $727 under the new rule.

"There are already enough challenges as it is, so what will happen is that because of this – especially in a market like we already have – people who've purchased...it's going to be more difficult for them to upgrade," she said.

"So it's really the upgrading market. Unless they have a sufficient amount of equity in their homes, it's going to be more difficult for them to upgrade."

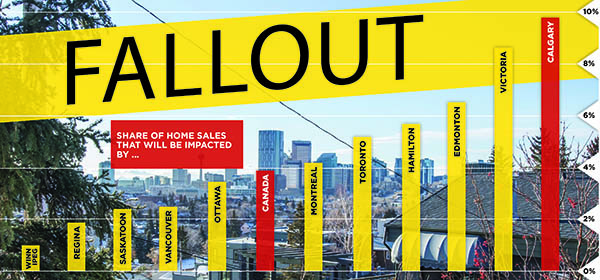

Calgary's housing market is at further risk due to its high proportion of high-ratio mortgages, which are defined as those with down payments of less than 20 per cent. A recent CIBC Economics report revealed nearly 10 per cent of new homes in the city priced between $500,000 and $1 million were purchased with high-ratio mortgage, twice the percentage seen in Toronto (five per cent) and four times Vancouver's 2.5 per cent.

"It's certainly not the vast majority of houses, but to the extent that it puts a downward push on the market, Calgary is one of the cities that would be affected," said Avery Shenfeld, managing director and chief economist for CIBC Economics.

"The irony being that Calgary house prices are already slipping, so it doesn't end up being that well targeted in the case of Calgary."

Through the first 11 months of 2015, Calgary's detached benchmark price was $514,536 with 30 per cent of year-to-date resale activity occurring in the $500,000-$999,999 range.

A recent report released by Mortgage Professionals Canada showed the amount put down by first-time buyers remained nearly unchanged since 1990 at 21 per cent. The same report showed the time spent saving for that same down payment had increased from 53 to 93 weeks in the same span – time that may increase as a result of the new federal regulations.

"It will take [first-time buyers] longer," said Lurie. "Because it's a down payment issue, it takes them longer to put away those funds. And it's not insignificant."

Experts also predict buying habits could change as a result of the new federal rules.

"You will get people shifting their behaviour," said Derek Burleton, vice-president and deputy chief economist, TD Bank Financial Group.

"For example, they could buy a cheaper home under $500,000 rather than something over that. No doubt that would mitigate the impact.

"You could get financing shifted to the non-bank sector – the sector that isn't regulated federally and even provincially – some of these alternative lenders, and that would mitigate some of the impact. As any rule, there will be efforts to mitigate the impact."

Given buyers might be motivated to keep their mortgages under $500,000, Lurie suggested sellers and homebuilders could also shift their pricing to mitigate the impact of the new rules.

"There might be more pressure now to keep [homes] under $500,000... so it can cause some further shifts down," she said. "Even new home construction, they may have to rethink [pricing] based on their demand profile."

Canadian Real Estate Association CEO Gary Simonsen stressed his concern about the implications for first-time buyers as well as "unintended collateral damage" for markets outside of Vancouver and Toronto.

"We are deeply concerned first-time homebuyers wishing to purchase a home will be greatly disadvantaged by the government's announcement, potentially keeping them out of the market," said Simonsen.

"Taken together, we believe there is a significant danger these changes could turn several balanced and buyers housing markets into distressed markets, causing unintended damage to the economy."

Tagged: affordability | Ann-Marie Lurie | Calgary Real Estate News | Canadian Real Estate Association | CIBC | Debt | downpayment | Homebuyers | house prices | Mortgage | YYCRE